All about Estate Planning Attorney

Table of ContentsGet This Report about Estate Planning AttorneyUnknown Facts About Estate Planning AttorneyWhat Does Estate Planning Attorney Mean?4 Simple Techniques For Estate Planning Attorney

Estate preparation is an action plan you can utilize to identify what happens to your possessions and commitments while you're to life and after you die. A will, on the other hand, is a legal document that outlines exactly how possessions are distributed, who deals with youngsters and pets, and any type of various other dreams after you pass away.

Claims that are declined by the executor can be taken to court where a probate court will have the final say as to whether or not the claim is valid.

5 Easy Facts About Estate Planning Attorney Shown

After the supply of the estate has actually been taken, the value of properties calculated, and tax obligations and financial debt repaid, the administrator will certainly after that seek consent from the court to distribute whatever is left of the estate to the recipients. Any inheritance tax that are pending will come due within 9 months of the date of death.

Each private areas their assets in the trust and names a person various other than their partner as the beneficiary. A-B counts on have come to be less prominent as the inheritance tax exemption functions well for most estates. Grandparents might move possessions to an entity, such as a 529 strategy, to sustain grandchildrens' education.

The Ultimate Guide To Estate Planning Attorney

This click here for info technique entails freezing the value of a possession at its worth on the day of transfer. As necessary, the quantity of possible funding gain at death is likewise iced up, pop over here allowing the estate coordinator to approximate their possible tax obligation liability upon death and much better prepare for the settlement of income taxes.

If sufficient insurance coverage profits are available and the policies are correctly structured, any type of earnings tax obligation on the regarded personalities of properties adhering to the fatality of a person can be paid without considering the sale of assets. Proceeds from life insurance that are received by the beneficiaries upon the death of the insured are generally income tax-free.

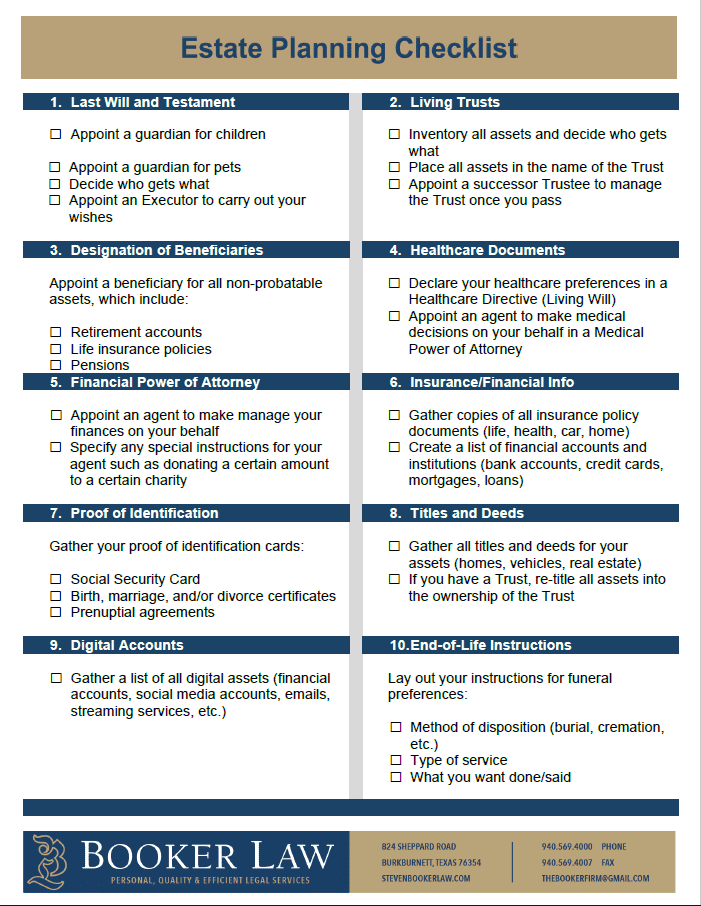

There are particular files you'll require as component of the estate preparation procedure. Some of the most common ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate planning is just for high-net-worth people. Estate intending makes it simpler for people to determine their dreams prior to and after they pass away.

Rumored Buzz on Estate Planning Attorney

You must begin planning for your estate as soon as you have any type of quantifiable property base. It's an ongoing process: as life progresses, your estate plan must change to match your circumstances, in line with your new goals.

Estate planning is commonly considered a device for the affluent. That isn't the case. It can be a helpful method for you to take care of your properties and responsibilities prior to and after you die. Estate preparation is additionally a great way for you to lay out prepare for the care of your minor children and animals and to outline your yearn for your funeral service and favorite charities.

Applications should be. Qualified candidates that pass the exam will be officially licensed in August. If you're qualified to sit for the exam from a previous application, you might submit the brief application. According to Read Full Report the rules, no accreditation will last for a duration much longer than 5 years. Discover out when your recertification application schedules.

Comments on “The 2-Minute Rule for Estate Planning Attorney”